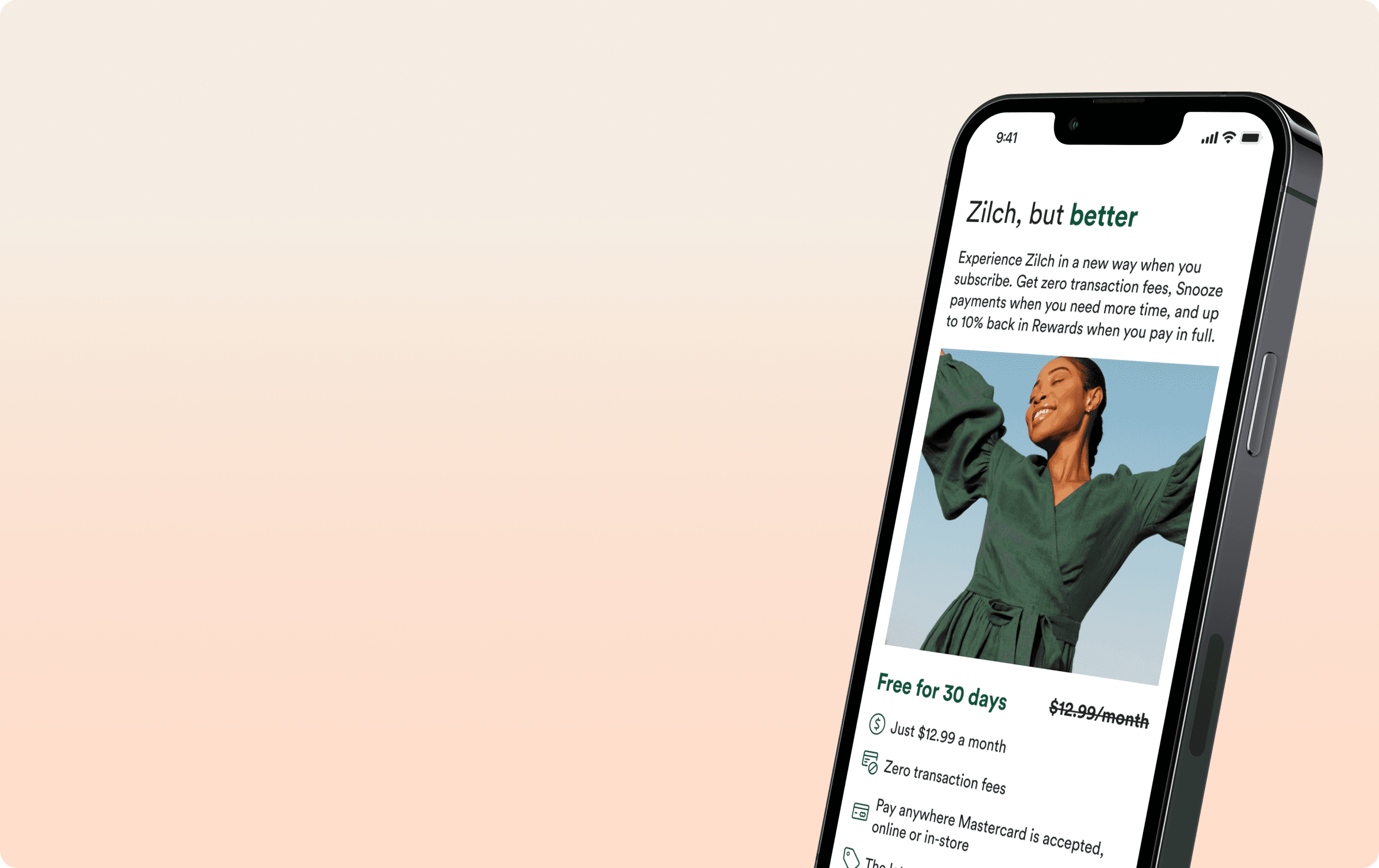

Zilch Subscriptions

Zilch is a buy now, pay later app that allows customer shop wherever Mastercard is accepted. Zilch launched in the United States in May 2022.

Zilch Subscriptions

Zilch is a buy now, pay later app that allows customer shop wherever Mastercard is accepted. Zilch launched in the United States in May 2022.

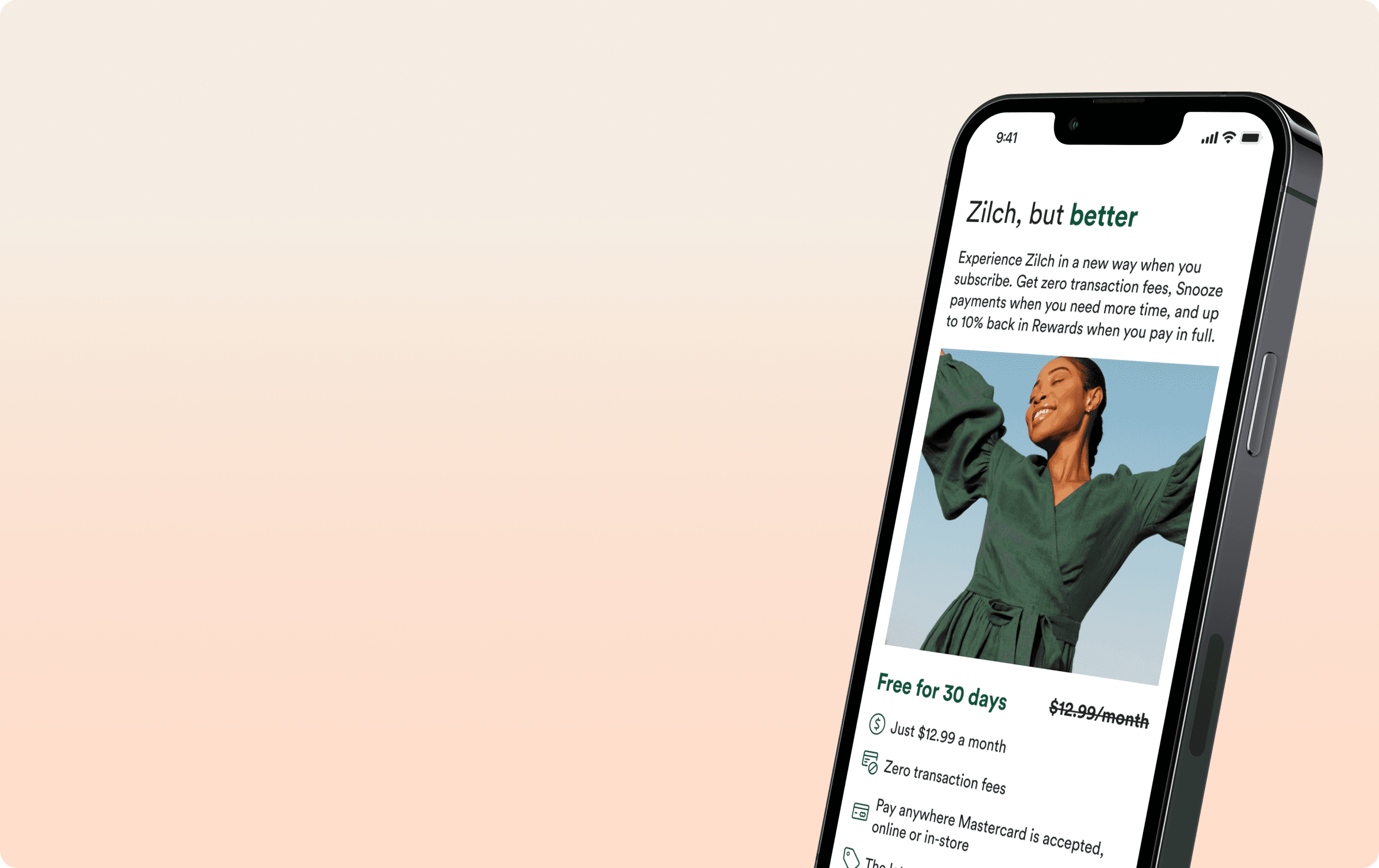

Zilch Subscriptions

Zilch is a buy now, pay later app that allows customer shop wherever Mastercard is accepted. Zilch launched in the United States in May 2022.

coming soon

PROJECT OVERIVEW

Zilch is seeking a scalable way to diversify our revenue streams beyond affiliate and interchange fees while being compliant with regulations. When we entered the US market, we adopted a term loan model for Zilch, where each purchase triggered a new loan requiring a separate TILA agreement. While charging fees on these loans was possible as APR, state-specific APR caps based on the origin of the finance charges posed a significant challenge.

We wanted a system that was:

Scalable: Easy to grow as our business grows.

Compliant: Followed all the relevant financial regulations.

Customer-friendly: Offered a smooth and convenient experience.

Diversified: Provided income beyond just affiliate fees.

We explored alternative models, including adding processing fees as a temporary solution. However, due to the limitations of processing fees, we transitioned to a closed line of credit model. This gives users a reusable credit limit, making it easier to manage their purchases and potentially support features like subscriptions.

A few tasks we took to before launching subscriptions:

Compliance Check: We consulted with key stakeholders to ensure everything adhered to regulations.

Competitive Analysis: We researched how other BNPL companies structure their fees.

Understanding Our Users: We talked to customers to see what kind of fees they'd be comfortable with.

Data-Driven Decisions: We analyzed our data to understand user spending patterns on processing fees.

We're excited to launch this new feature soon! While we can't share all the details just yet, we'll be sure to provide updates, performance metrics, and more in-depth designs once it's live.

coming soon

PROJECT OVERIVEW

Zilch is seeking a scalable way to diversify our revenue streams beyond affiliate and interchange fees while being compliant with regulations. When we entered the US market, we adopted a term loan model for Zilch, where each purchase triggered a new loan requiring a separate TILA agreement. While charging fees on these loans was possible as APR, state-specific APR caps based on the origin of the finance charges posed a significant challenge.

We wanted a system that was:

Scalable: Easy to grow as our business grows.

Compliant: Followed all the relevant financial regulations.

Customer-friendly: Offered a smooth and convenient experience.

Diversified: Provided income beyond just affiliate fees.

We explored alternative models, including adding processing fees as a temporary solution. However, due to the limitations of processing fees, we transitioned to a closed line of credit model. This gives users a reusable credit limit, making it easier to manage their purchases and potentially support features like subscriptions.

A few tasks we took to before launching subscriptions:

Compliance Check: We consulted with key stakeholders to ensure everything adhered to regulations.

Competitive Analysis: We researched how other BNPL companies structure their fees.

Understanding Our Users: We talked to customers to see what kind of fees they'd be comfortable with.

Data-Driven Decisions: We analyzed our data to understand user spending patterns on processing fees.

We're excited to launch this new feature soon! While we can't share all the details just yet, we'll be sure to provide updates, performance metrics, and more in-depth designs once it's live.

coming soon

PROJECT OVERIVEW

Zilch is seeking a scalable way to diversify our revenue streams beyond affiliate and interchange fees while being compliant with regulations. When we entered the US market, we adopted a term loan model for Zilch, where each purchase triggered a new loan requiring a separate TILA agreement. While charging fees on these loans was possible as APR, state-specific APR caps based on the origin of the finance charges posed a significant challenge.

We wanted a system that was:

Scalable: Easy to grow as our business grows.

Compliant: Followed all the relevant financial regulations.

Customer-friendly: Offered a smooth and convenient experience.

Diversified: Provided income beyond just affiliate fees.

We explored alternative models, including adding processing fees as a temporary solution. However, due to the limitations of processing fees, we transitioned to a closed line of credit model. This gives users a reusable credit limit, making it easier to manage their purchases and potentially support features like subscriptions.

A few tasks we took to before launching subscriptions:

Compliance Check: We consulted with key stakeholders to ensure everything adhered to regulations.

Competitive Analysis: We researched how other BNPL companies structure their fees.

Understanding Our Users: We talked to customers to see what kind of fees they'd be comfortable with.

Data-Driven Decisions: We analyzed our data to understand user spending patterns on processing fees.