ZILCH INTEGRATION WITH PLAID

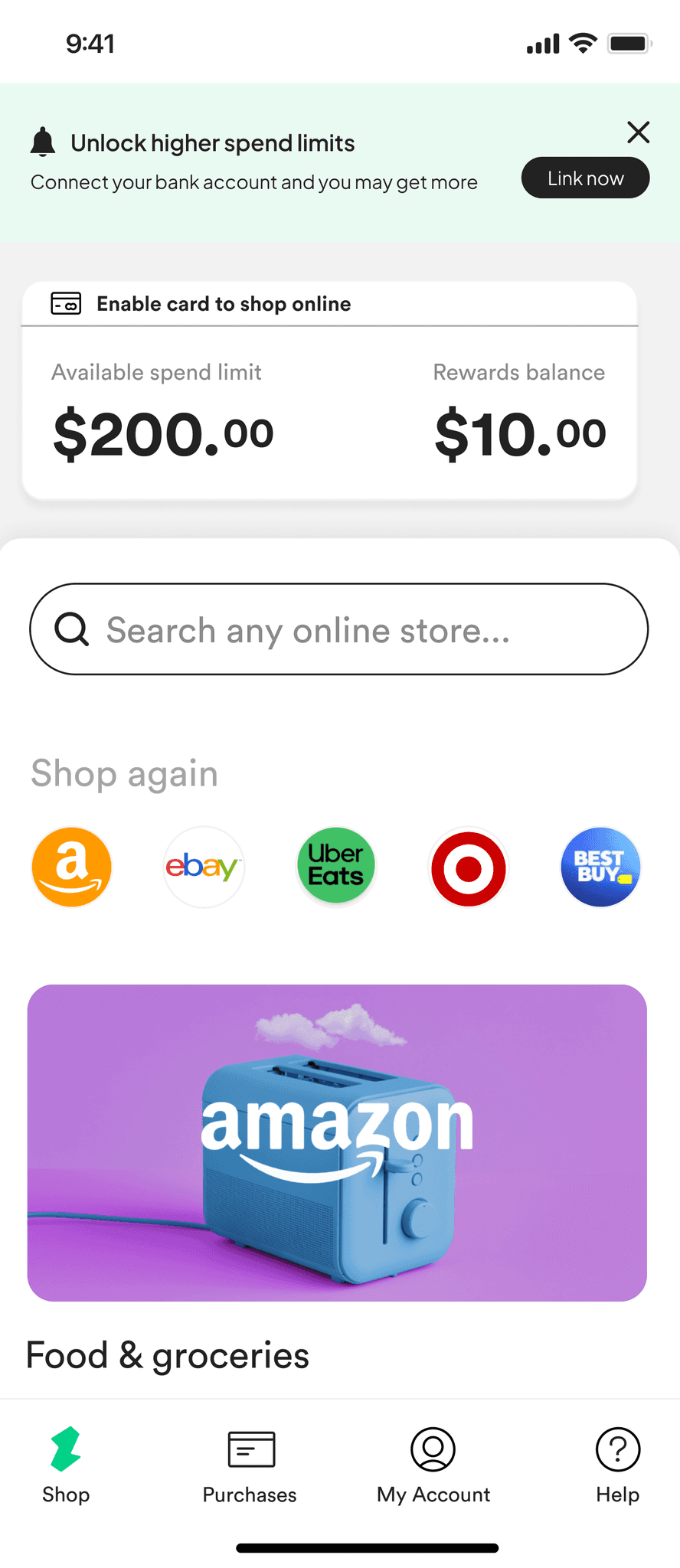

Zilch is a buy now, pay later app that allows customer shop wherever Mastercard is accepted. Zilch launched in the United States in May 2022.

ZILCH INTEGRATION WITH PLAID

Zilch is a buy now, pay later app that allows customer shop wherever Mastercard is accepted. Zilch launched in the United States in May 2022.

ZILCH INTEGRATION WITH PLAID

Zilch is a buy now, pay later app that allows customer shop wherever Mastercard is accepted. Zilch launched in the United States in May 2022.

Shipped 2023

PROJECT OVERIVEW

Through regular meetings with our customer support team, we identified a significant trend: a high volume of inquiries regarding Zilch spend limit increases. To understand this issue better, we conducted interviews with a diverse group of customers, including those who reached out to custom support to inquiry about their spen and those who hadn't.

Key customer insights:

Responsible Users Seek Reward: Customers with a history of on-time or early payments expressed frustration at the lack of corresponding limit increases. They felt their responsible behavior wasn't reflected in their spending power.

Competitive Landscape: Some customers felt limited by Zilch's spend limits compared to what they could access with other Buy Now, Pay Later (BNPL) products.

Growth Expectation: While new users understood a lower initial limit, established users felt their limits should automatically increase with responsible usage over time.

Inflationary Impact: Customers expressed feeling constrained by their current limits due to rising inflation and overall economic factors causing price increases.

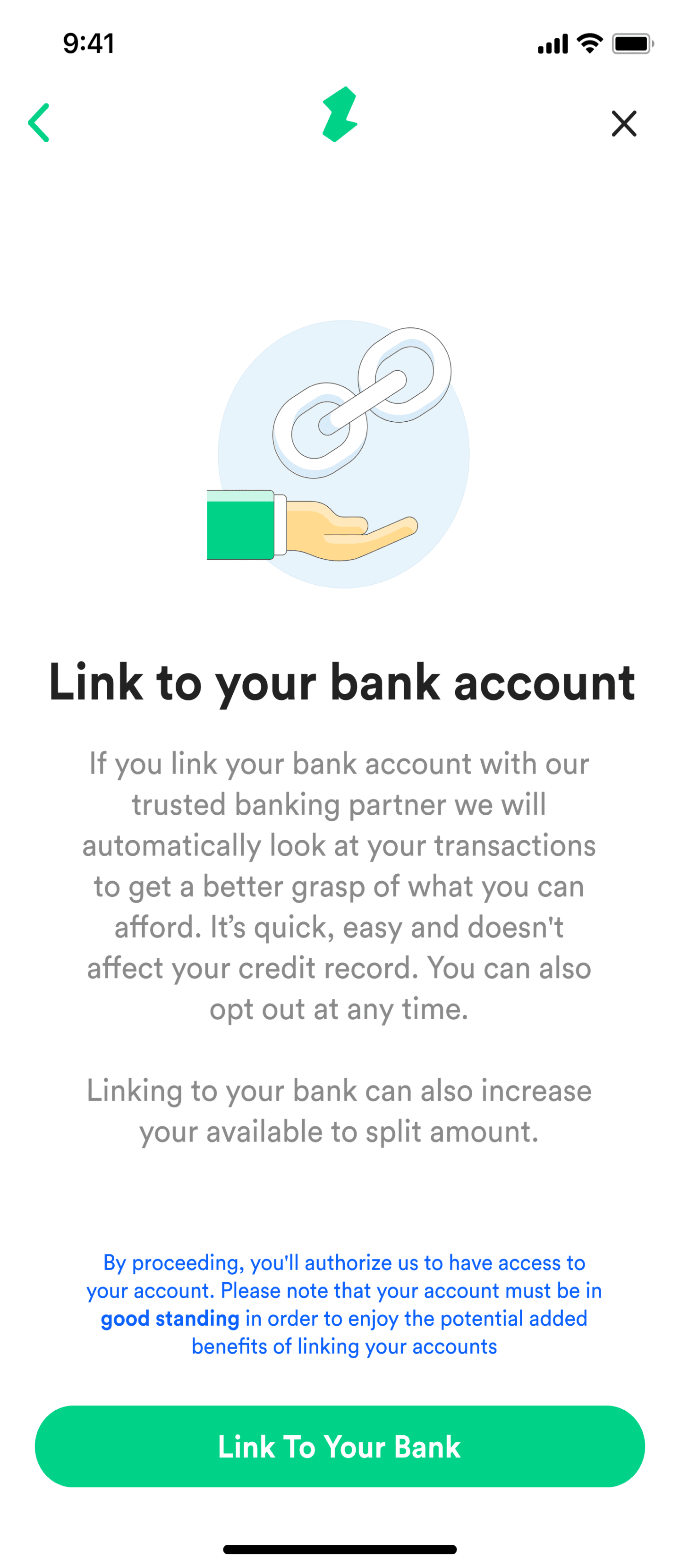

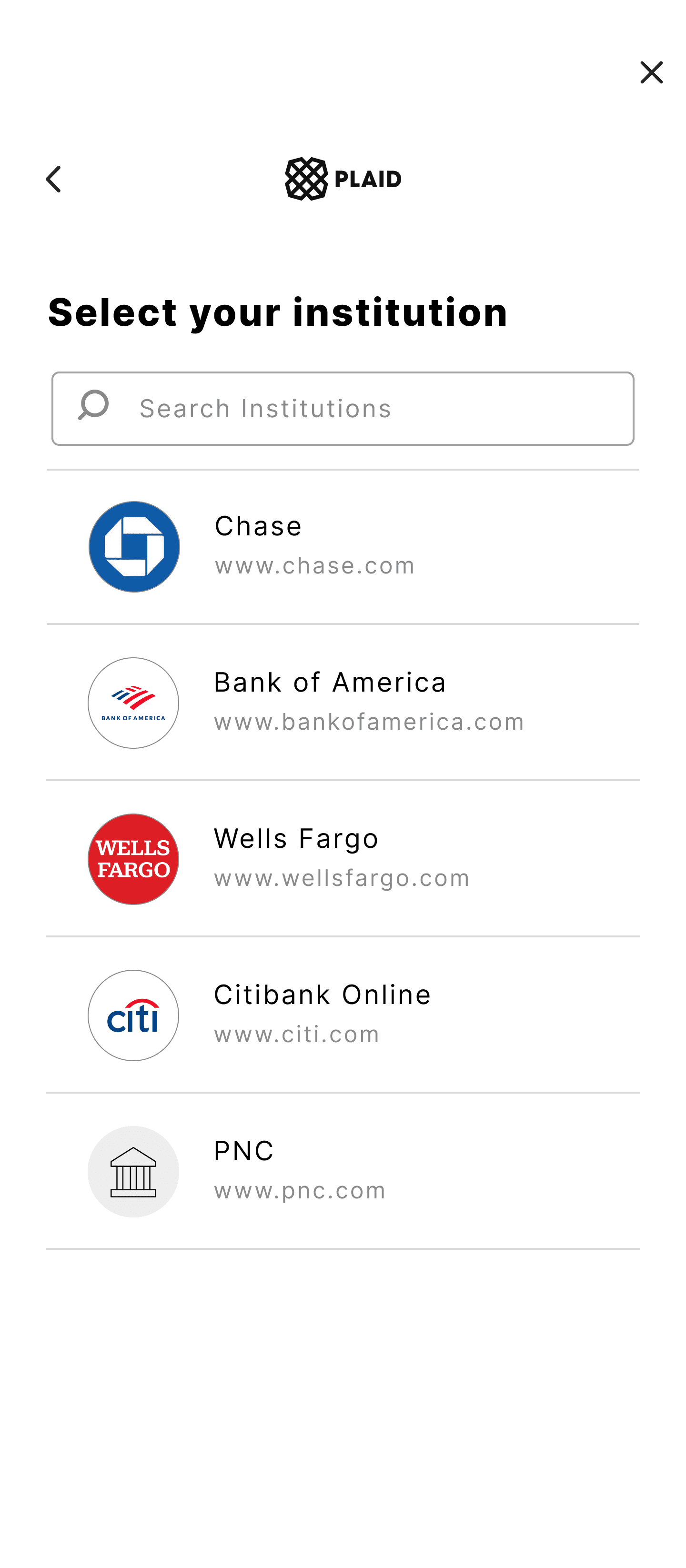

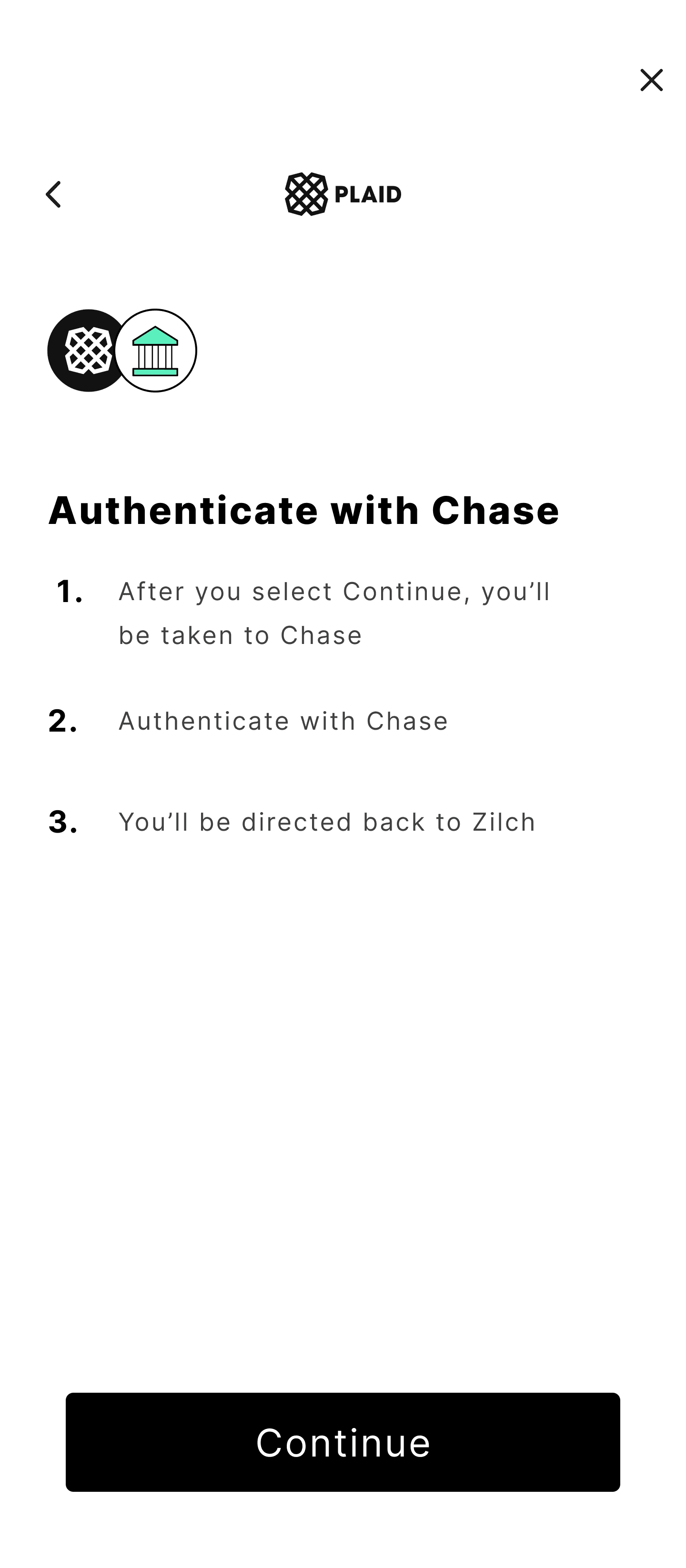

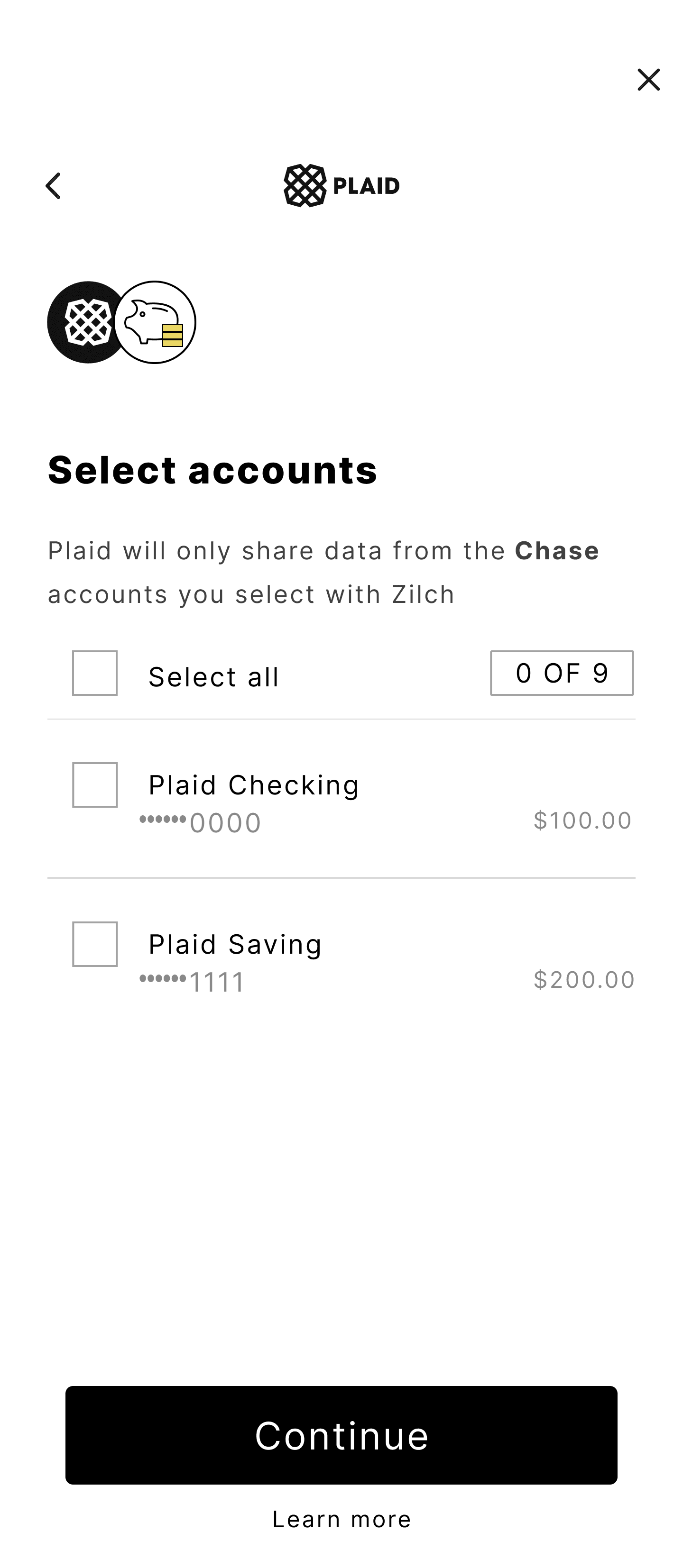

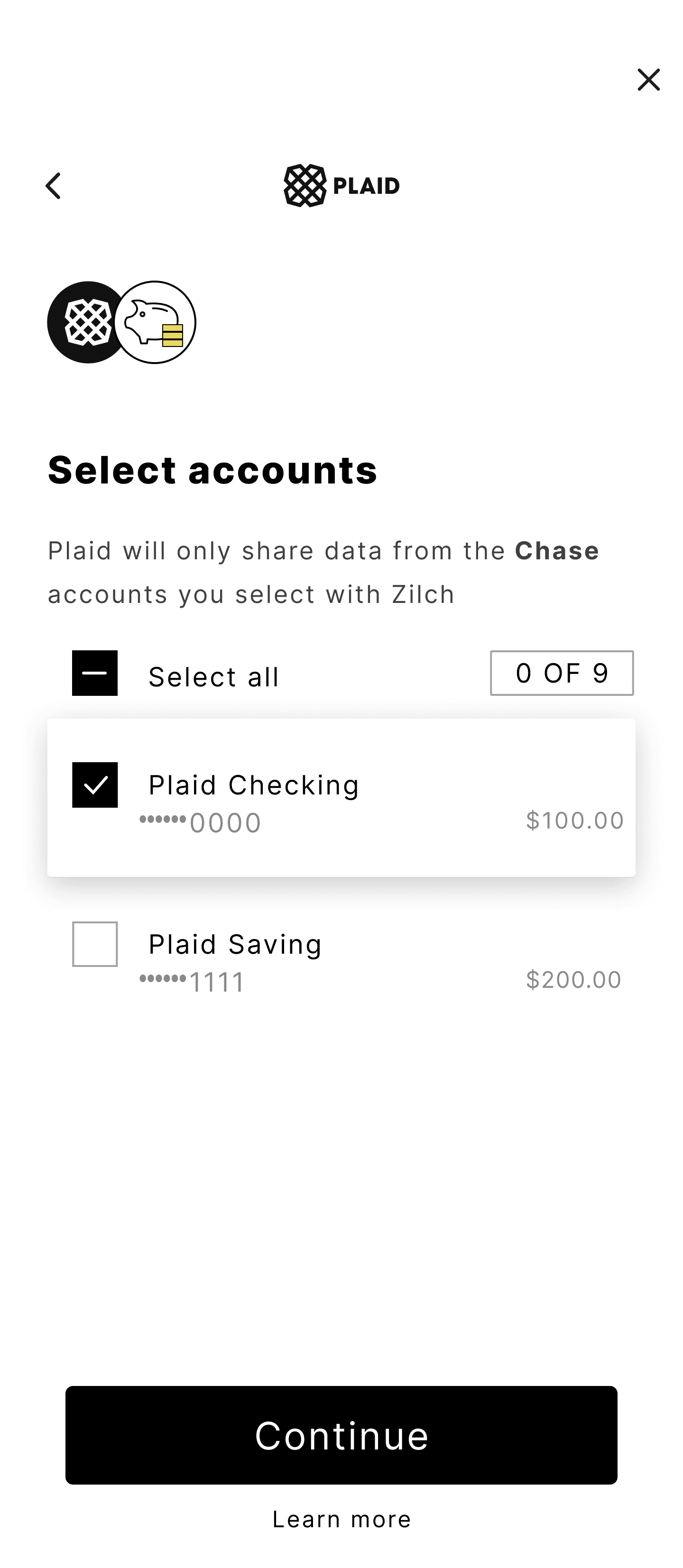

We collaborated with the risk and compliance team. Their primary concern was the lack of data to differentiate good and bad users. To enhance risk assessment capabilities, we decided to integrate with Plaid, a financial data service. Plaid provided additional insights into customer finances such as average balances, estimated income, and account ownership. This richer data empowered our team to develop more accurate and income-based risk models.

Prior to integration, we conducted another survey to gauge customer comfort with Plaid. Encouragingly, all surveyed customers expressed comfort connecting their bank accounts and had prior experience using Plaid.

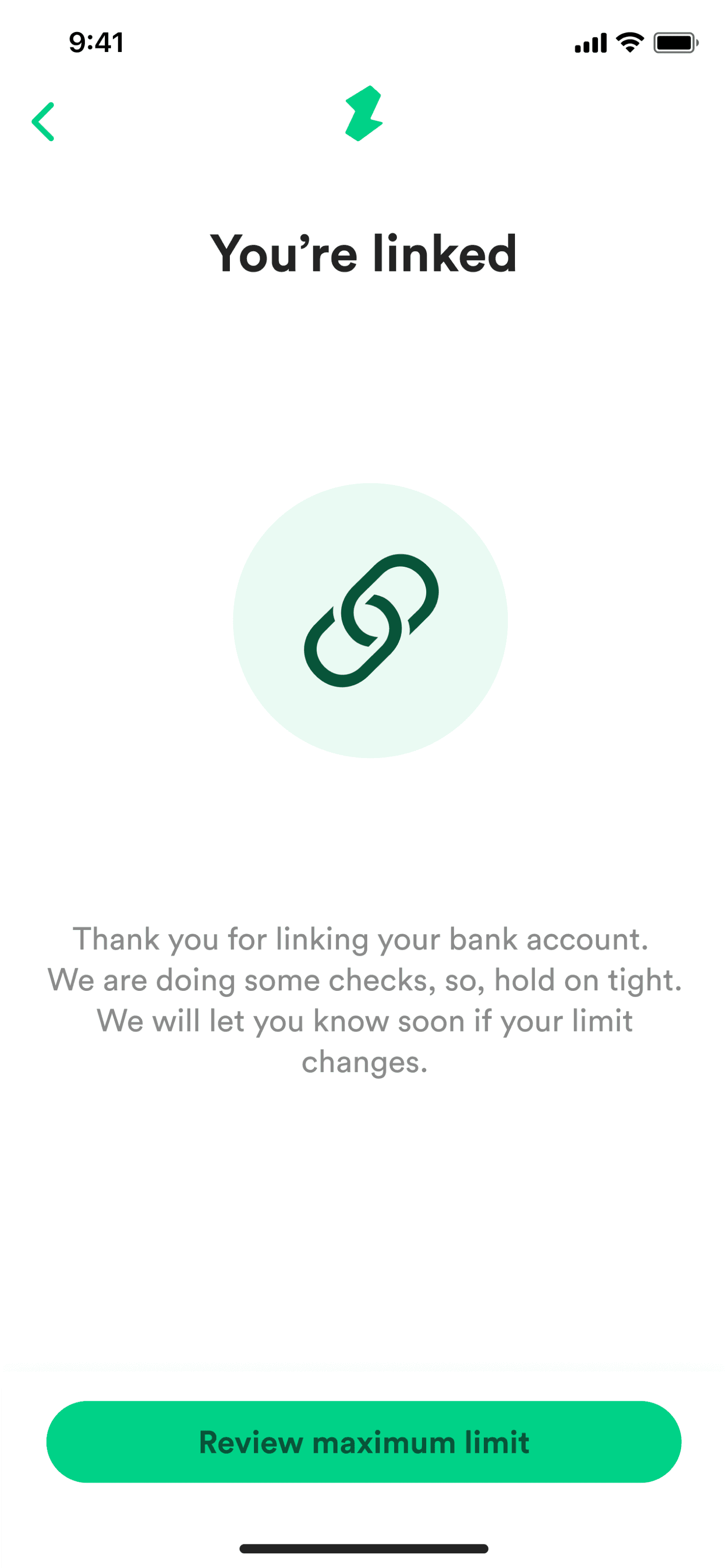

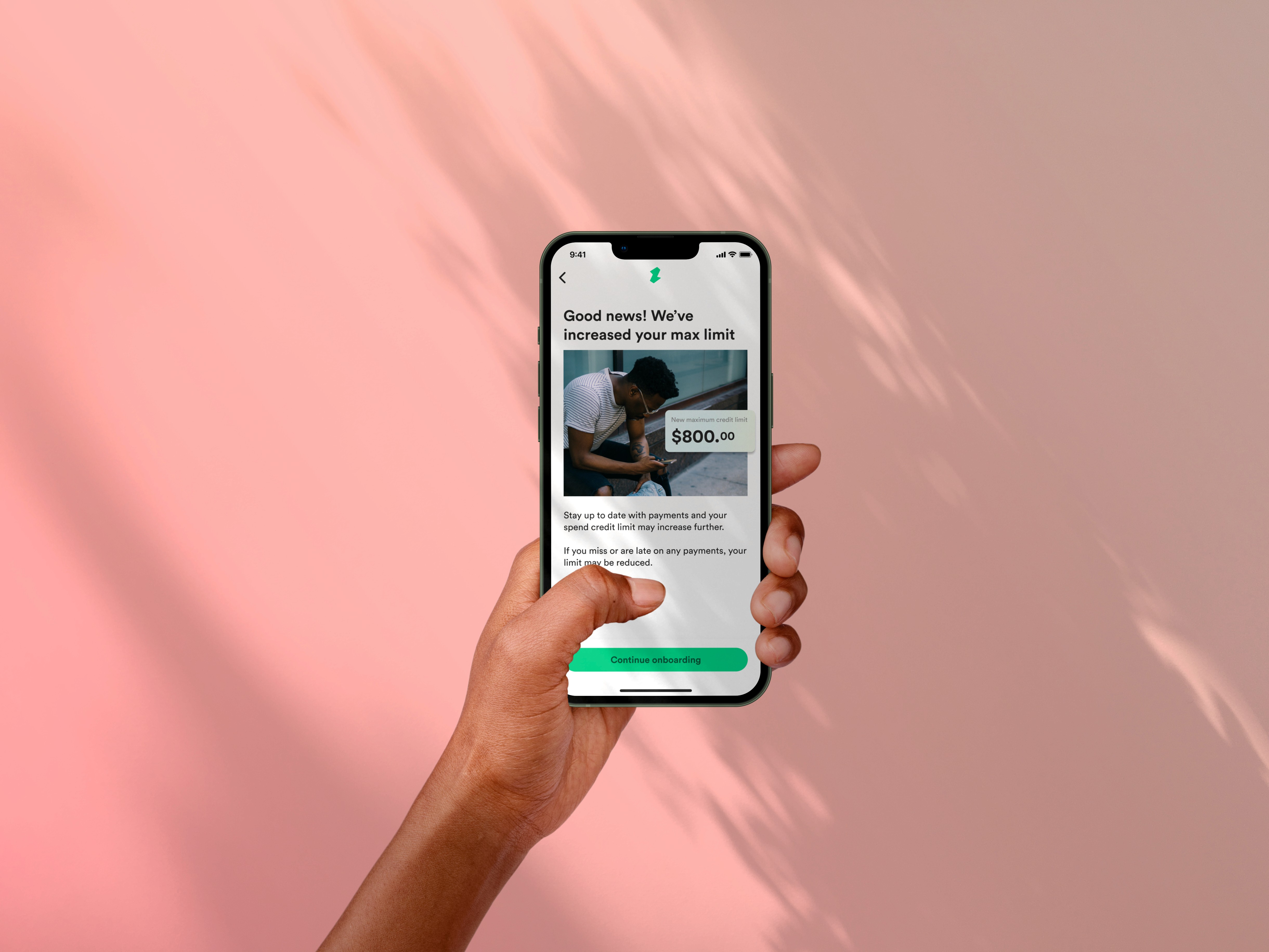

Plaid's data provided a more holistic view of a customer's financial health. This allowed us to develop nuanced risk models. Plaid integration led to significant improvements:

Increased lending amounts to responsible customers.

Reduced bad debt.

High customer adoption (95% linked their accounts within 15 days).

Shipped 2023

PROJECT OVERIVEW

Through regular meetings with our customer support team, we identified a significant trend: a high volume of inquiries regarding Zilch spend limit increases. To understand this issue better, we conducted interviews with a diverse group of customers, including those who reached out to custom support to inquiry about their spen and those who hadn't.

Key customer insights:

Responsible Users Seek Reward: Customers with a history of on-time or early payments expressed frustration at the lack of corresponding limit increases. They felt their responsible behavior wasn't reflected in their spending power.

Competitive Landscape: Some customers felt limited by Zilch's spend limits compared to what they could access with other Buy Now, Pay Later (BNPL) products.

Growth Expectation: While new users understood a lower initial limit, established users felt their limits should automatically increase with responsible usage over time.

Inflationary Impact: Customers expressed feeling constrained by their current limits due to rising inflation and overall economic factors causing price increases.

We collaborated with the risk and compliance team. Their primary concern was the lack of data to differentiate good and bad users. To enhance risk assessment capabilities, we decided to integrate with Plaid, a financial data service. Plaid provided additional insights into customer finances such as average balances, estimated income, and account ownership. This richer data empowered our team to develop more accurate and income-based risk models.

Prior to integration, we conducted another survey to gauge customer comfort with Plaid. Encouragingly, all surveyed customers expressed comfort connecting their bank accounts and had prior experience using Plaid.

Plaid's data provided a more holistic view of a customer's financial health. This allowed us to develop nuanced risk models. Plaid integration led to significant improvements:

Increased lending amounts to responsible customers.

Reduced bad debt.

High customer adoption (95% linked their accounts within 15 days).

Shipped 2023

PROJECT OVERIVEW

Through regular meetings with our customer support team, we identified a significant trend: a high volume of inquiries regarding Zilch spend limit increases. To understand this issue better, we conducted interviews with a diverse group of customers, including those who reached out to custom support to inquiry about their spen and those who hadn't.

Key customer insights:

Responsible Users Seek Reward: Customers with a history of on-time or early payments expressed frustration at the lack of corresponding limit increases. They felt their responsible behavior wasn't reflected in their spending power.

Competitive Landscape: Some customers felt limited by Zilch's spend limits compared to what they could access with other Buy Now, Pay Later (BNPL) products.

Growth Expectation: While new users understood a lower initial limit, established users felt their limits should automatically increase with responsible usage over time.

Inflationary Impact: Customers expressed feeling constrained by their current limits due to rising inflation and overall economic factors causing price increases.

We collaborated with the risk and compliance team. Their primary concern was the lack of data to differentiate good and bad users. To enhance risk assessment capabilities, we decided to integrate with Plaid, a financial data service. Plaid provided additional insights into customer finances such as average balances, estimated income, and account ownership. This richer data empowered our team to develop more accurate and income-based risk models.

Prior to integration, we conducted another survey to gauge customer comfort with Plaid. Encouragingly, all surveyed customers expressed comfort connecting their bank accounts and had prior experience using Plaid.

Plaid's data provided a more holistic view of a customer's financial health. This allowed us to develop nuanced risk models. Plaid integration led to significant improvements:

Increased lending amounts to responsible customers.

Reduced bad debt.

High customer adoption (95% linked their accounts within 15 days).

CUSTOMER JOURNEY